Introduction

Beyond Meat (NASDAQ: BYND) is "one of the fastest growing food companies in the United States, offering a portfolio of revolutionary plant-based meats. We build meat directly from plants, an innovation that enables consumers to experience the taste, texture and other sensory attributes of popular animal-based meat products while enjoying the nutritional and environmental benefits of eating our plant-based meat products." (definition from 10-K).

A diverse mix of factors is contributing to a paradigm shift in the food systems and in particular the meat production industry, driving the transition from animal-based meats to plant-based meats.

The climate crisis and the research for more sustainable and efficient production methods are the main drivers behind this secular transformation, facilitated by increased consumer awareness of the long-term health benefits of plant-based diets, and the negative environmental consequences and animal welfare issues of animal-based meats.

Beyond Meat’s offer of plant-based meats is not targeted strictly at the vegan or vegetarian-minded consumer, but more widely at the traditional animal-based meats consumers by providing a product that replicates the texture, the taste, the aroma, and the nutritional content of the animal-based meats, while preventing its shortcomings.

This strategy allows Beyond Meat to target the whole meat market, while addressing the consumers' concerns detailed above.

In an industry where the possibility to increase production efficiency has already been pushed to its limits, Beyond Meat has placed innovation at the core of its product design and production process. Focus on innovation together with the simplified value chain of the plant-based meats versus the animal-based meats allows for significant potential efficiency gains while providing benefits in terms of human health, impact on climate change, animal welfare, and reduced utilization of natural resources.

In a time of global pandemic, the availability of a safer supply chain with the presence of strong quality control measures is an additional advantage.

Investment in research and development is the enabler of the continuous innovation of Beyond Meat, necessary for designing ever-improving products in terms of providing consumers with an experience similar to that of animal-based meats, but with better nutritional profiles.

The company foresees increasing R&D expenses in absolute dollar terms, but decreasing in percentage terms (of revenues), as it continues growing its business.

Through its focus and commitment on innovation, the company is well-positioned to achieve benefits in a sector characterized by the stagnant and unsustainable business model of its traditional players.

Market Size and Growth

According to data from Fitch Solutions Macro Research, the meat industry is the largest category in food and in 2017 generated estimated sales across retail and food service channels of approximately $270 billion in the United States and approximately $1.4 trillion globally.

From 2016, when the flagship product Beyond Burger was introduced, to 2019 the company achieved a compounded annual growth rate of 164% with revenues growing from $16 million to $297.8 million.

For the six months ending June 27, 2020, revenues in the US were $169 million (80.4% of the total), while internationally they were $41 million (19.5% of the total).

The company acquired a manufacturing facility in Europe, located in the Netherlands, which is expected to be operational by the end of 2020 and is building two additional production facilities in the Jiaxing Economic and Technological Development Zone close to the megacity of Shanghai with expected full-scale production in early 2021.

While growth is still expected to continue to be robust in the US, the creation of these facilities supports the case for an increasing component of growth coming from the “International” area.

Sustained growth of production will be fundamental to achieving higher economies of scale, allowing the company to pass the cost reductions to the customers, reducing prices of products and driving further sales growth.

Intrinsic Valuation

In order to calculate the intrinsic value of Beyond Meat I used a discounted cash flow (DCF) model.

When applying a DCF model to a young growth company, due to the high level of uncertainty, it is recommended to try forecasting future revenues rather than future earnings.

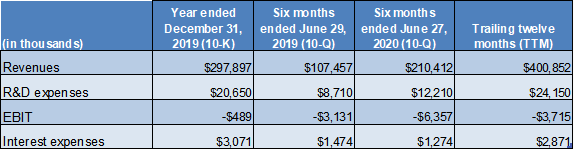

The data used for the analysis are based on the last available quarterly report (10-Q June 2020) and the only annual report (10-K December 2019) issued by the company. In the table below are provided the trailing twelve months values for some of the inputs used in the model.

Revenues Growth Rates

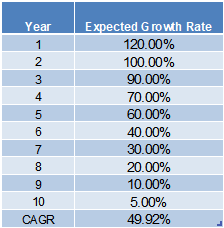

Between 2016 and 2019 the company achieved a revenues compounded annual growth rate (CAGR) of 164%. I expect the company to continue experiencing sustained growth in future years driven by both increasing sales in the US and considerably higher growth in the international area.

As revenues grow over time in absolute terms, the growth rate should gradually flatten out for the well-known effect of size on growth.

Based on the yearly growth rates in the table above, the corresponding ten-year compounded annual growth rate (CAGR) is 49.92%. Resulting total sales at the end of the tenth year of $22.9 billion represent, using Fitch Solutions Macro Research data for 2017, a market share for the US and international of 8.5% and 1.6%, respectively.

Based on the yearly growth rates in the table above, the corresponding ten-year compounded annual growth rate (CAGR) is 49.92%. Resulting total sales at the end of the tenth year of $22.9 billion represent, using Fitch Solutions Macro Research data for 2017, a market share for the US and international of 8.5% and 1.6%, respectively.

The industry’s market size estimates provided by Fitch for 2017 and used in the calculation above appear to be still reasonable if we consider that according to GlobalData’s latest COVID-19 adjusted forecasts, the global meat market will value $1.3 trillion by the end of 2020, reflecting a year-on-year (YoY) decline of 5.3%.

With regards to estimated revenues, as a reference, JBS S.A. - the largest meat company in the world - has annual sales of $52 billion, while Tyson Foods (NYSE:TSN) has $42 billion. Thus, the projected revenues in ten years imply that Beyond Meat should become one of the largest producers in the world.

After year ten, when I expect the company to reach stable growth state, I assume in the model that the growth rate will be equal to the risk-free rate (a proxy for expected rate of growth of the economy).1

Capitalization of Research and Development Expenses

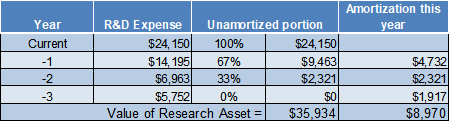

Innovation is at the core of the company and a key differentiator for Beyond Meat. As a result, research and development (R&D) expenses are a relevant item in the income statement.

As the benefits of this type of expenses occur over the course of various years, they are more appropriately classified as capital expenditures. I have capitalized R&D expenses assuming a three years amortization period, which is the average value for the companies in the food processing industry.

(values in thousands)

By adding back to the trailing twelve months EBIT, the R&D expenses ($24 million) and subtracting the amortization ($9 million) of the R&D asset created, the resulting adjustment to the operating income is $15 million.

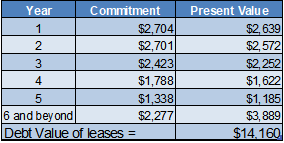

Conversion of Operating Leases into Debt

Beyond Meat started to report operating leases from January 1, 2020, according to ASU 2016-02, while continuing to report previous periods according to ASC 840. For a more precise calculation of the trailing twelve months figures I performed the conversion of the operating leases into debt myself. The discount factor used corresponds to the pre-tax cost of debt reported in the cost of capital section below.

(values in thousands)

The resulting debt value of operating leases ($14.2 million) is quite close to the value ($13.9 million) reported by the company in the June 2020 quarterly report (10-Q).

The trailing twelve months value of the depreciation on the operating lease asset that I obtained is $2 million and the adjustment to operating earnings is $348 thousand.

Pre-tax Operating Margin

As a result of adjusting the operating income for the capitalization of R&D expenses and the conversion of operating lease commitments into debt, base year pre-tax operating margin is 2.95%.

I assume that operating margins will increase rather quickly in the first five years, due to economies of scale and improvements in the efficiency of the production process. After year five, margins should increase more gradually and stabilize around the industry average level (9%) in steady state. The rationale is that as of now Beyond Meat benefits from first mover advantage and a proprietary technology. Over time though, greater competition by incumbents transitioning to plant-based meat production and the emergence of new competitive players will keep pressure on margins towards industry average level.

Net Operating Loss Carryforwards

As of June 2020, net loss carryforwards amounted to approximately $360 million.

The company has evaluated the limitations on the possibility to realize its deferred tax asset in accordance with the US tax code for companies that undergo an “ownership change” (defined as change greater than 50% by value in equity ownership over a three-year period). Due to uncertainties in the evaluation, the company is maintaining a full valuation allowance against the entire amount until a full determination is achieved.

Conservatively, I did not consider any amount of net loss carryforwards in the model.

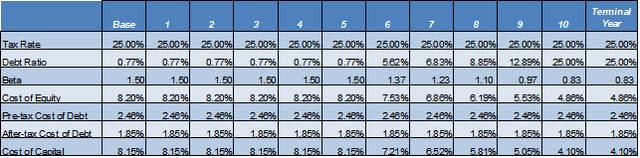

Cost of capital

To calculate the cost of capital, I set the marginal tax rate to 25%, and I used as risk-free rate the current value of the yield on the ten-year US treasury bond (0.7%).

The average beta for the food processing sector is 0.88, which becomes 0.70 when unlevered and corrected for cash.

For the first years while the company is still young, I assumed a beta of 1.50 attributing the company a higher sensitivity to market risks (e.g. due to higher operating leverage and more discretional products) than the competitors. Moving towards steady state I assumed the beta will converge to the industry average, which levered back using a projected debt/equity of 25% (sector average 37%) equals 0.83.

As equity risk premium I used the current implied equity risk premium for the US (5%).

The pre-tax cost of debt is obtained by adding the default spread to the risk-free rate. As an approximation I assumed a BBB rating for Beyond Meat given its young growth company status, the value of the default spread corresponding to this rating is 1.76%.

Reinvestment and Return on Invested Capital

To calculate the reinvestment necessary to support growth each year, I assumed a sales/capital ratio of 2.5. This ratio measures how many dollars of revenues are generated by each dollar of increase in invested capital. For reference, the average sales/capital ratio for the food processing sector is 1.36, while for the whole market (excluding financials) is 1.22.

The ratio for the company in the last two years has been roughly above 3, and a 2.5 value is compatible with its characteristics of innovative company in high growth phase.

After-tax return on invested capital (ROIC) in stable growth state is assumed to be 15%, in line with the average for the sector.

Employee Options

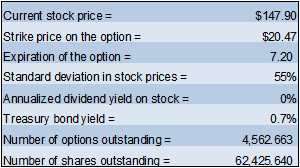

To determine the value of the employee options I used the Black and Scholes valuation model using as inputs the parameters provided in the last quarterly report (June 2020 10-Q), with the exception of the risk-free rate for which I used the updated value.

(Number of options and shares in thousands)

The resulting value per option is $129.76 and the value of all options outstanding is $592 million.

Intrinsic Value

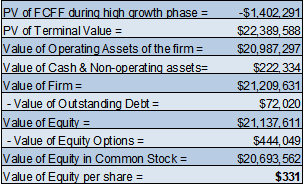

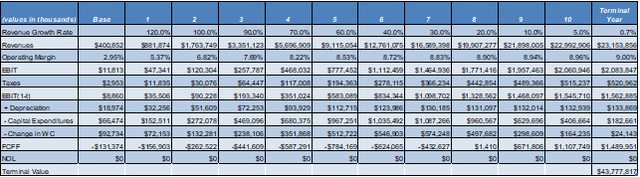

Below are detailed the calculations of the DCF model using the inputs provided.

(base year EBIT adjusted for capitalization of R&D expenses and operating leases)

(values in thousands, except the value of equity per share)

The resulting value per share of $331 represents a potential upside of 124% versus the latest closing price of $147.9 (September 24, 2020).

Monte Carlo Simulation

The result generated by the model is affected by the uncertainty surrounding many of the assumptions that were made. Beyond Meat is still at an early stage of development with limited operational history and the estimated values of the variables could vary significantly over an extended time period.

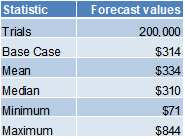

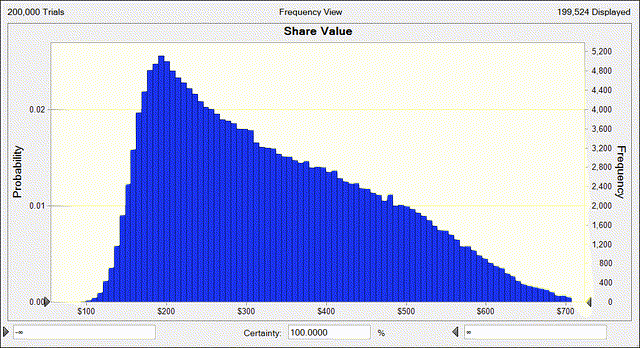

To get a better understanding of the potential outcomes I performed a Monte Carlo simulation running 200,000 trials.

To perform the simulation, I selected the most significant variables in terms of impact on the valuation and determined the more appropriate statistical distribution to be used for each of them.

Below are the assumptions regarding the variables and the associated distributions.

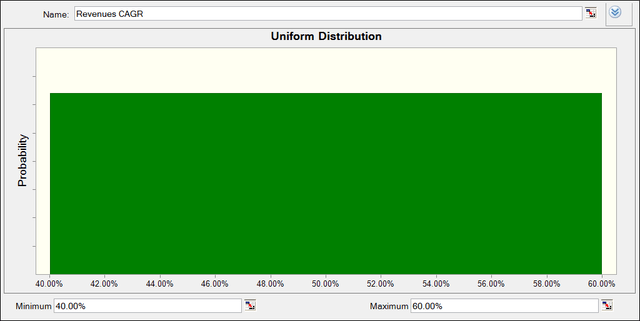

The estimation of annual growth rates of revenues is extremely uncertain. Thus, I used a uniform distribution for revenues CAGR, which attributes the same probability to each value, with a wide range of variability (between 40% and 60%).

The estimation of annual growth rates of revenues is extremely uncertain. Thus, I used a uniform distribution for revenues CAGR, which attributes the same probability to each value, with a wide range of variability (between 40% and 60%).

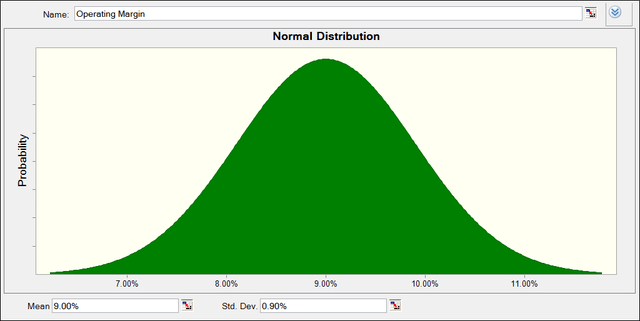

For the operating margin in stable growth I used a normal distribution where the average corresponds to the industry average and the standard deviation is 0.90%.

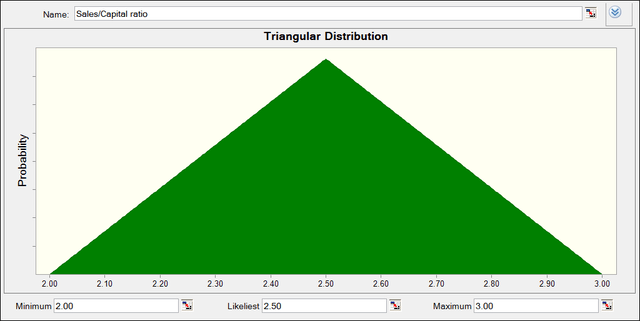

I assumed a triangular distribution for the sales/capital ratio where the likeliest value is 2.5 (same as base model), the minimum 2 and the maximum 3.

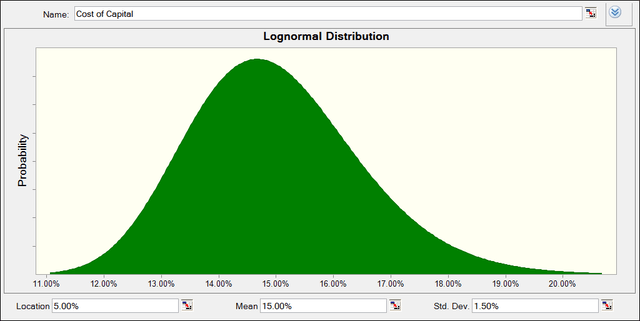

And lastly, I used a lognormal distribution for the cost of capital, with the mean corresponding to the industry average.

Below is the distribution of the results of the simulation.

Below are the summary statistics of the simulation.

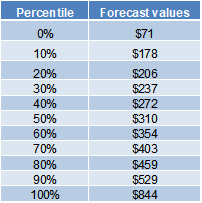

In the table below are provided the percentiles for the forecasted values.

From the results of the simulation we can make some considerations, for example if we consider the current price ($147.9) there is a 97.8% probability that the shares are undervalued and 2.2% probability that they are overvalued.

With a $200 price the probability that the shares are undervalued is still a significant 82%, and we must reach a price of $280 to obtain a more balanced probability (57%) of the shares being undervalued.

Overall, the results of the simulation support the bullish case for Beyond Meat highlighting potential more upside than downside at current price levels.

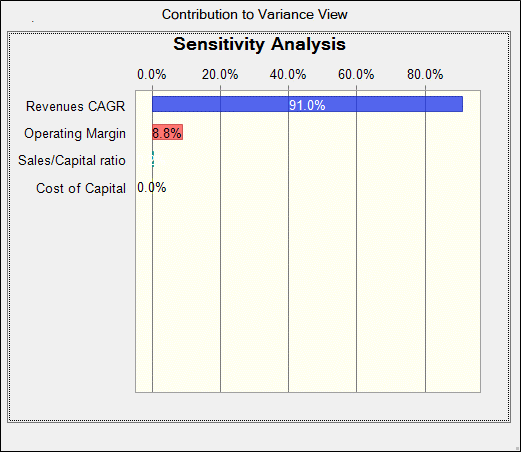

One tool that is particularly useful in understanding how much the different variables contribute to the variance of the result is the sensitivity analysis chart.

From the chart above it appears that Revenues CAGR contributes to the resulting variance of the share price in the model for the considerable amount of 91%.

We can conclude that the values of sales growth that the company will be able to achieve going forward is the best indicator in assessing the possibilities of reaching a higher intrinsic value.

Conclusion

The unsustainable current production model and heightened consumer awareness regarding health impacts, environmental burden and animal welfare are contributing to a disruptive trend away from animal-based meats to plant-based meats.

Beyond Meat through its proprietary technology, successful existing products and focus on continuous innovation with significant R&D investments is well-positioned to take advantage of this secular opportunity.

The company is still young and in the early stages of development in an industry dominated by big players, making it harder to perform predictions and estimations.

Nonetheless, it is exactly in cases like these where it is most important and useful to undergo the effort and try to estimate the value.

The application of a discounted cash flow model, with all the assumptions requested in this specific case, provides a valuation which is significantly higher than the current stock price.

To account for the variability of the conditions I applied a Monte Carlo simulation which reinforces the compelling investment case in Beyond Meat.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

The Link LonkSeptember 28, 2020 at 02:18PM

https://ift.tt/30b37uU

Beyond Meat Still Has A Lot Of Beef - Seeking Alpha

https://ift.tt/2RxTDX4

Beef

No comments:

Post a Comment